How Much Tax Is Deducted From Paycheck In Quebec

The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent table 1. At the time of publication the employee portion of the Social Security tax is assessed at 62 percent of gross wages while the Medicare tax is assessed at 145 percent.

The Ultimate List Of Tax Deductions For Online Sellers Tax Deductions Business Tax Deduction

But thats not always the case.

How much tax is deducted from paycheck in quebec. Your employer or payer will calculate how much income tax to deduct by referring to your total claim amount on Form TD1 Personal Tax Credits Return and using approved calculation methods. Net pay Your net or take home pay is your gross pay less all amounts deducted and remitted to CRA on your behalf by your employer. The Quebec Income Tax Salary Calculator is updated 202122 tax year.

165 14 x 118 Some employees related to the employer may be exempt from paying Employment Insurance Read our article to learn more. Several other income tax-free states likewise place tax burdens on workers of less than 20 including Wyoming 185 Texas 18 and Nevada 176. Easy Rate QnA forum.

There is no age limit for deducting income tax and there is no employer contribution required. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances. Federal Tax Due.

Being required to make instalment payments. How much tax is deducted from a paycheck in ca What is the average percent of taxes taken out of a paycheck. New Hampshire stands out with a tax.

If your employer deducts too much income tax you receive it back as a refund when you file your taxes. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. As an employer or payer you are responsible for deducting income tax from the remuneration or other income you pay.

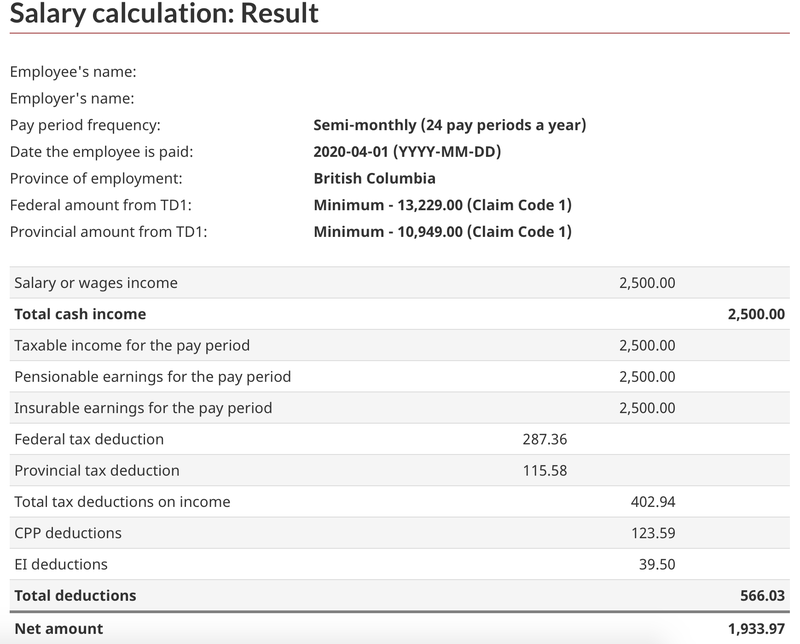

Required deductions Income tax. The provincial income tax deduction also depends on the annual income but it has different rates from province to province. If you receive employment income or any other type of income your employer or payer will deduct income tax at source from the amount paid.

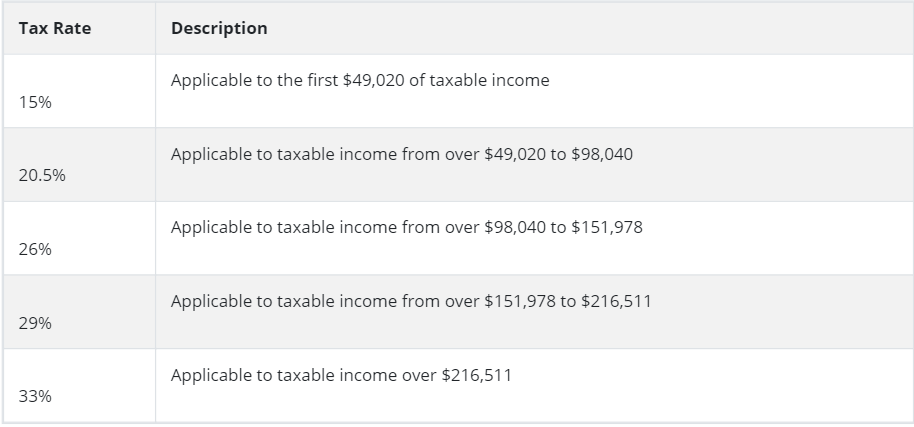

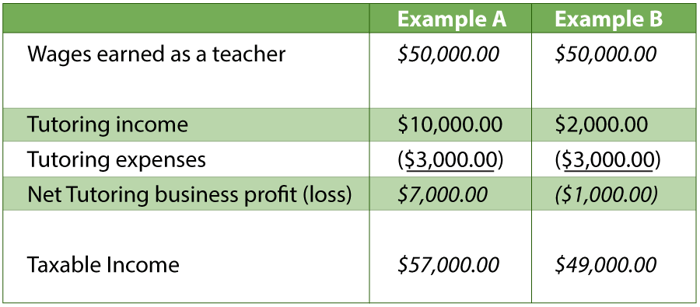

Overview There are three deductions an employer must take from your paycheque. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. This means that the tax rate goes up as your income goes up.

The rates apply to taxable incomeadjusted gross income minus either the standard deduction or allowable itemized deductions. 56300 Maximum employee premium. This is the same tool that a small employer could use to determine exactly how much in payroll taxes to withhold from your paycheck.

The table below shows the federal tax rates that apply. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. You also can claim your CPP and EI contributions as a deduction.

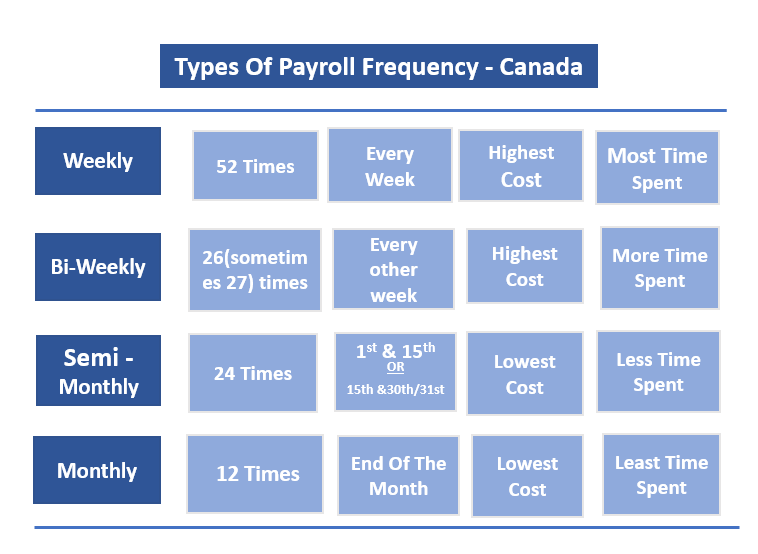

The federal income tax deduction depends on the level of the annual income and it ranges between 15 and 33. Most employees and recipients fill out Form TD1. The tax is progressive five tax brackets it starts at 15 for incomes up to 49020 CAD and ends at 33 for incomes greater than 216511 CAD.

This means that high-income residents pay a higher percentage than low-income residents. 66434 Maximum employer premium. Washington deserves special mention with a tax burden of only 198 leaving take home pay of 56264.

Reduced rate for Quebec. Your average tax rate is 221 and your marginal tax rate is 349. Unsurprising taxpayers in these states usually get to keep a higher percentage of their income.

You can request that we authorize your employer or a payer to increase the amount of income tax deducted from your remuneration. How Your Paycheck Works. Income tax and contributions for Canada Pension Plan and Employment Insurance.

7 Zeilen Income taxes paid Federal This is the amount you would have paid as income tax see the. This marginal tax rate means that your immediate additional income will be taxed at this rate. More than 89080 but not more than 108390.

We have forms to help you determine how much income tax to deduct. That means that your net pay will be 40512 per year or 3376 per month. Income up to the standard deduction or itemized deductions is thus taxed at a zero rate.

Paying an overly high balance when you file your income tax return. The Payroll Deductions Online Calculator PDOC calculates federal and provincial payroll deductions for all provinces except for Quebec and territories based on the information you provide. Quebec Parental Insurance Plan.

Ask your question fast. More than 44545 but not more than 89080. Increasing the amount of income tax deducted at source can help you avoid.

Federal Tax is calculated based on a persons gross taxable income after the non-refundable tax credits have been applied QPIP CPPQPP and EI premiums. In Canada we pay income tax at graduated rates. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

Self Employed Tax Deductions In Canada Discussed

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Business Tax Business Tax Deductions Small Business Bookkeeping

What S The Difference Between A Tax Credit And A Tax Deduction In Canada Loans Canada

Taxes In Montreal Workingholidayincanada Com

Mathematics For Work And Everyday Life

Everything You Need To Know About Running Payroll In Canada

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

What Are All Those Deductions And Taxes On My Paycheque Good Money By Vancity

Everything You Need To Know About Running Payroll In Canada

How To Calculate Payroll Tax Deductions Monster Ca

Income Tax Deduction Table Section 80 Tax Deductions Income Tax Income Tax Return

How To Do Payroll In Canada A Step By Step Guide The Blueprint

Income Tax Deductions Infographics Tax Deductions Income Tax Income Tax Return

What Are Some Self Employed Tax Deductions In Canada

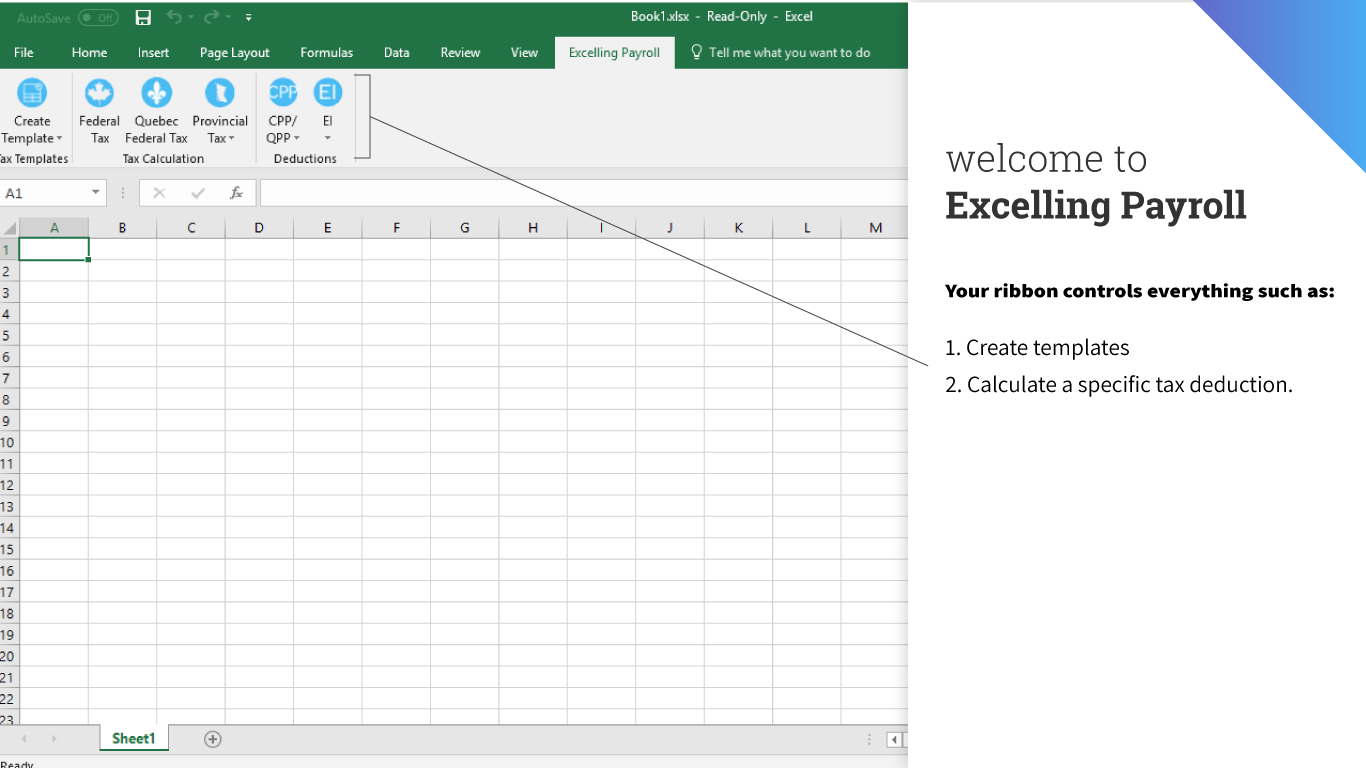

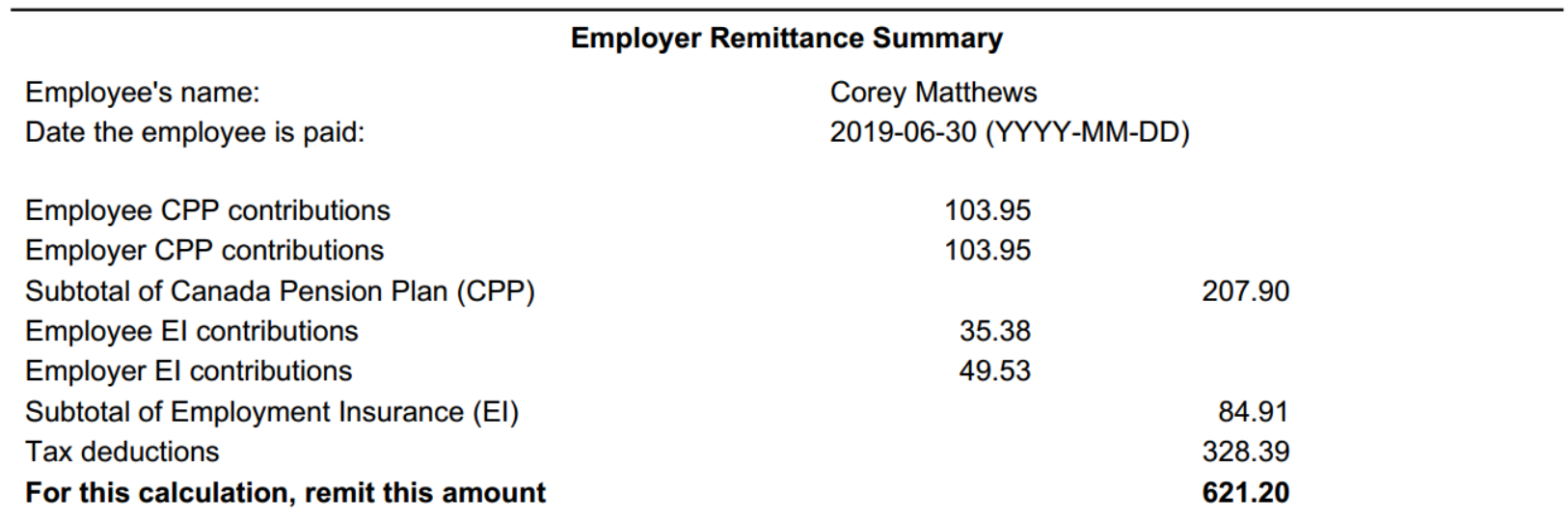

Excelling Payroll Canadian Payroll Tax Deduction

Information On Filing T4s Rl 1s And T4as For Small Business Owners Small Business Business Small Business Owner

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Post a Comment for "How Much Tax Is Deducted From Paycheck In Quebec"