2020 W 4 Payroll Calculator

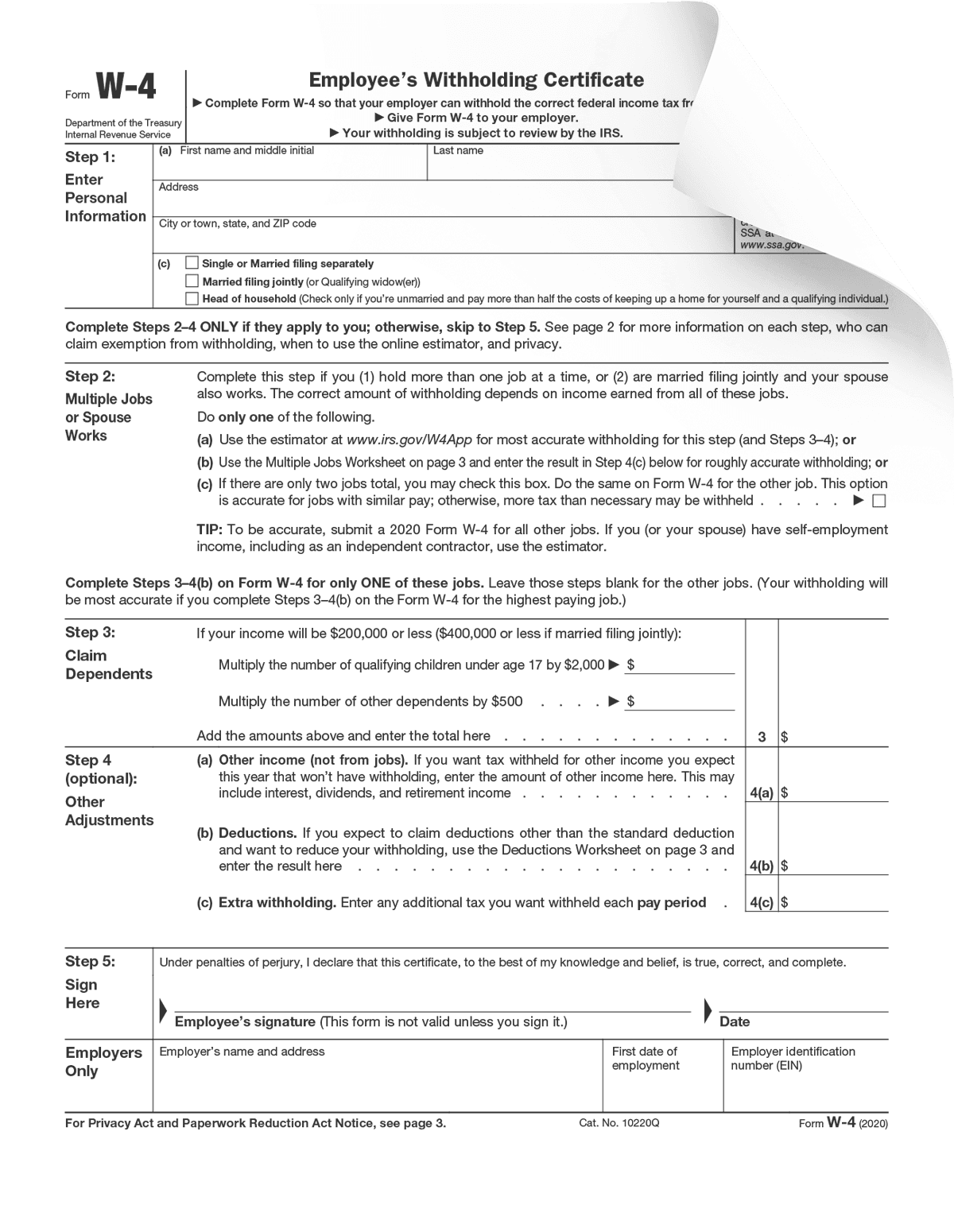

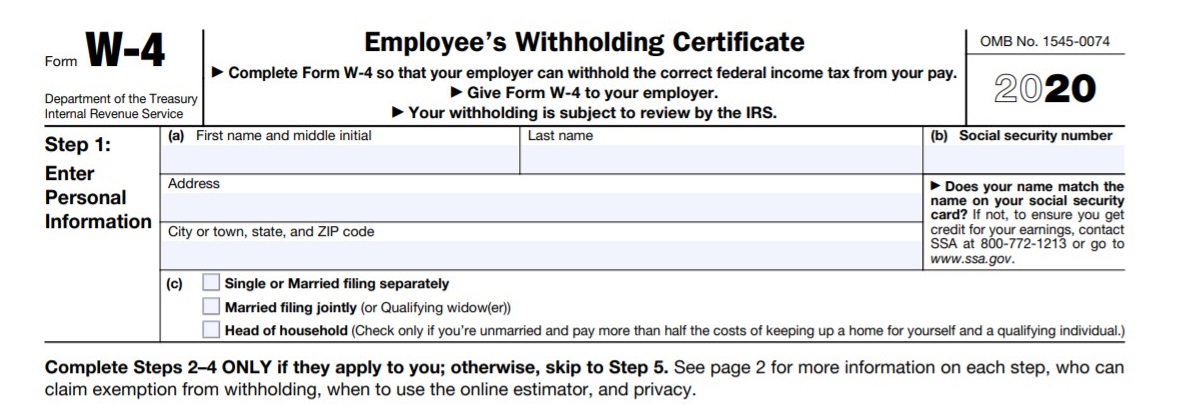

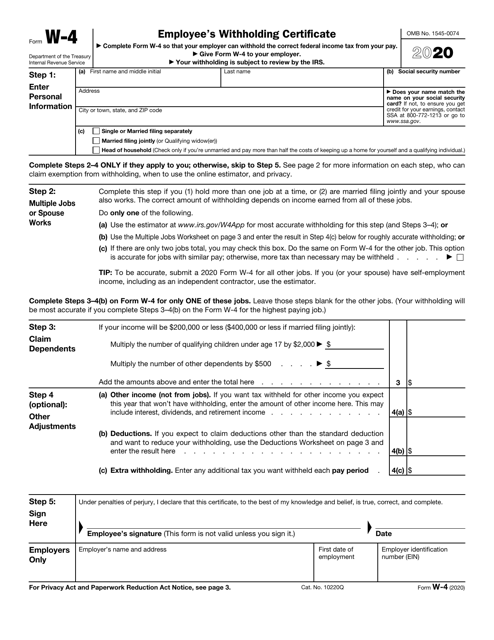

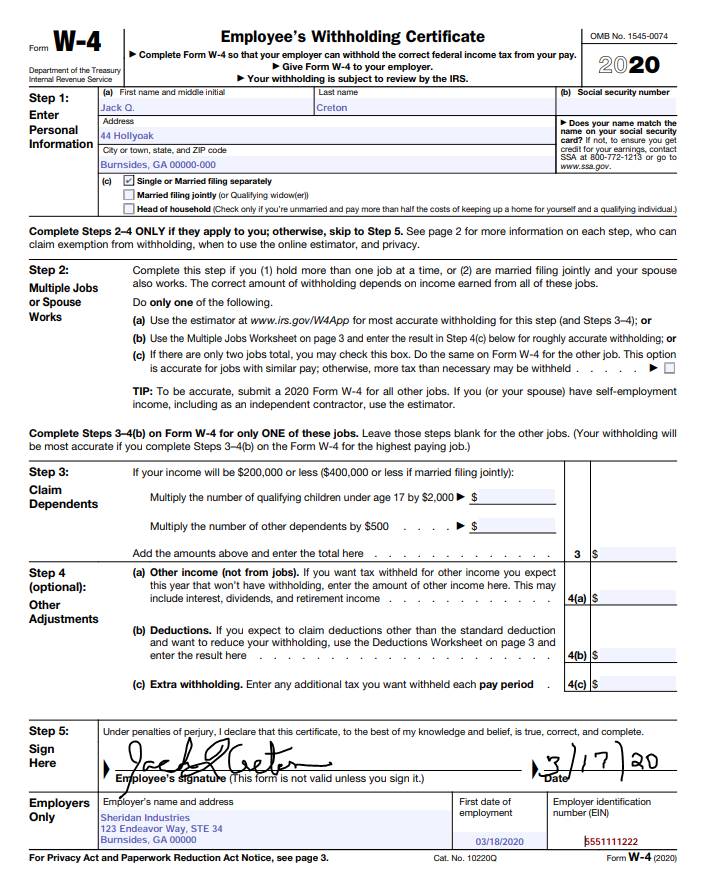

A few changes that will be on the new Form W-4 might include non-wage income tax credits additional incomes and elimination of the number of allowances. Check if you have multiple jobs.

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Every time you start a new job you complete Form W-4.

2020 w 4 payroll calculator. Choose Tax Year and State. At the end of the paycheck calculator you will find instructions on how to increase or decrease your W-4 tax withholding per paycheck. So if you do not file a new Form W-4 for 2020 your withholding might be higher or lower than you intend.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. On a side note if you use the withholding calculator to make alterations to the amount of your paycheck thats. You can also fine-tune your tax withholding by requesting a certain dollar amount of additional withholding from each paycheck on your W-4.

Tax Year for Federal W-4 Information. Find out now before you submit your W-4 to your employer and estimate your 2020 Return now. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

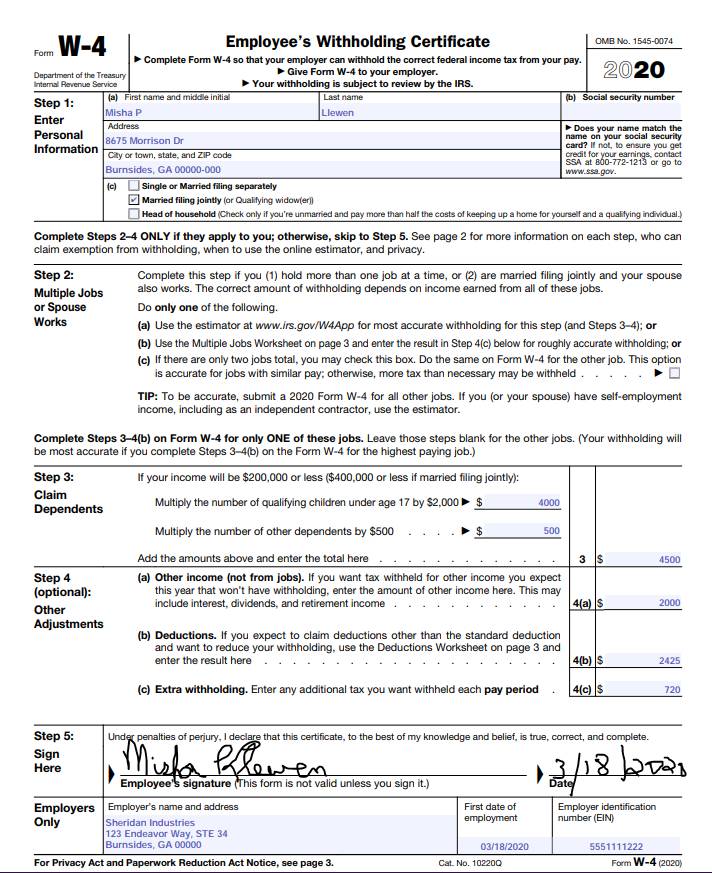

The Form W4 Withholding Calculator takes you through each step of completing the Form W4. Steps to calculate the 2020 tax manually 1. If you do use the 2020 W-4 be sure to enter the additional information required.

If you changed your withholding for 2019 the IRS reminds you to be sure to recheck your withholding at the start of 2020. If it shows Taxes owed decrease your W-4 Allowances now. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees wages.

If you are still confused and do not want to work through the 2020 W-4 form on your own our paycheck calculator has incorporated all the new changes. If this is the case you may see a difference between your pay and the Payroll Deductions Online Calculator. W-4 2020 or After and Step 2c is Unselected Valid federal tax tables are Standard WH-SM-Sep Standard WH-MJ.

This calculator is intended for use by US. Use the Income Tax Withholding Assistant if you typically use Publication 15-T to determine your. Follow the steps in this sample if the Form W-4 is from 2019 or earlier or if the Form W-4 is from 2020 or later and the box in Step 2 of Form W-4 is NOT checked.

The Form W4 provides your employer with the details on how much federal and in some cases state and local tax should be withheld from your paycheck. She receives one paycheck each month. With the results from the withholding calculator you can complete a new Form W-4 to change how much of your paycheck is withheld for tax purposes.

Other Income not from jobs Other Deduction. Or Select a state. For the remainder of 2020 the CRA will expect this change to be implemented on a best efforts basis.

Our Calculators Eliminate the Guess Work. Choose how often you receive your paycheck. States impose their own income tax for tax year 2020.

What if my W-4 calculator results show more withholding than. Filing Status Children under Age 17 qualify for child tax credit Other Dependents. Standard WH-H of H is NOT a valid tax table if W-4 if from 2019 or before.

Later in 2019 information regarding the 2020 forms should be released to employers and payroll processors to ensure a smooth transition process. It can also be used to help fill steps 3 and 4 of a W-4 form. Payroll professionals are urging individuals to complete a paycheck checkup to ensure that the correct amount of tax is being withheld from each paycheck.

The Nuts Bolts of Tax Withholdings. The sooner you submit the new form the sooner the changes will take effect. Your net Paycheck will decrease.

Start the free 2020 W-4 Tax Withholding Calculator. Our W-4 calculator is forward looking meaning your W-4 Form updates apply to your future paycheck withholding. A mid-year withholding change in 2019 may have a different full-year impact in 2020.

What you do not know is if the Allowance adjustment will result in your goal not to owe Taxes in 2020. As a result your employer may be using a different Yukon Basic Personal Amount to calculate your pay. Karen is married filling jointly with 1 allowance.

Its a short form. Depending on your situation the calculator will recommend changes you can make to adjust your tax withholding. Learn more here about the purpose of the form W-4 and how to complete it correctly based on your tax return goals.

The calculation is based on the 2021 tax brackets and the new W-4 which in 2020 has had its first major. Her salary rate is 39000. To make sure you withhold the right amount for the rest of the tax year you should provide the completed W-4 s to your employer s as soon as possible after completion.

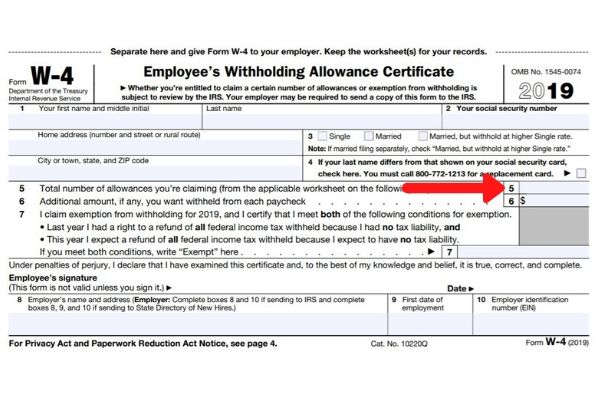

It will help you as you transition to the new Form W-4 for 2020 and 2021. Major changes to the W4 and subsequent payroll withholding calculation in 2020 - Heres how it works in Excel with the combined percentage withholding tables. Employers may ask employees who have a pre-2020 Form W-4 on file to complete a new 2020 W-4 however employees are permitted to decline and keep existing withholding elections in place.

Our paycheck calculator for employers makes the payroll process a breeze.

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

What Is Form W 4 What Do I Do As An Employer Updated For 2019 Gusto

New 2020 Form W 4 Employee S Withholding Certificate Payroll Services

Figuring Out Your Form W 4 How Many Allowances Should You Claim Allowance Form Finance

What Is A W4 Form And How Does It Work Form W 4 For Employers

W4 Form 2021 Printable How To Fill Out W4

How To Fill Out A W 4 Form Without Errors That Would Cost You Employee Tax Forms Tax Forms Job Application Form

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2021

How To Fill Out The W 4 Tax Withholding Form For 2021

Making Sense Of Irs Form W 4 Changes Syndeo

Irs Form W 4 Download Fillable Pdf Or Fill Online Employee S Withholding Certificate 2020 Templateroller

How To Fill Out The New W 4 Form Arrow Advisors

What Is A W4 Form And How Does It Work Form W 4 For Employers

Post a Comment for "2020 W 4 Payroll Calculator"