Adp Paycheck Calculator Gross Up

To start complete the easy-to-follow form below. Subtract the total tax rates from the number 1.

43 Payroll Templates Page 2 Free To Edit Download Print Cocodoc

Calculate your gross wages prior to the withholding of taxes and deductions.

Adp paycheck calculator gross up. Important Note on CalculatorThe calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. California Gross-Up Calculator Results Below are your California salary paycheck results. To calculate tax gross-up follow these four steps.

This will give you the gross amount that you need to give the employee for them to get their promised net wages. The payroll calculator from ADP is easy-to-use and FREE. Using take-home pay calculate the gross that must be used when calculating payroll taxes.

Use our free Gross Up Pay Calculator by inputting your net pay pay frequency filing status state amount paid to date and any withholding and deductions to calculate your gross salary. Divide the net payment by the net percent. Lets say you want to give an employee a net bonus of 500.

1 tax net percent. The Viventium Gross-up Calculator helps you determine the number of gross wages before taxes and deductions are withheld given a specific take-home pay amount. Check your answer by calculating gross payment to net payment.

With the gross up component the net pay for a reimbursement is 504945. The calculator that is provided on this web site is only meant to provide general guidance and estimates about. Divide the net wages by the net percentage.

It determines the amount of gross wages before taxes and deductions that are withheld given a specific. Dividing this by the number of whole or part days the employee either worked or was on paid leave or holidays during that period. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be.

Add up all federal state and local tax rates. The payroll tax modeling calculators powered by the Symmetry Tax Engine include federal state and local taxes and benefits and other deductions and integrate directly into your website or application via an API or. Adding up the employees gross earnings for the period and.

Subtract the total tax percentage from 100. Use this federal gross pay calculator to gross up wages based on net pay. Bonuses are subject to taxes.

The Gross-Up Payroll Calculator can easily determine gross pay by entering take-home pay and any deductions. They should not be relied upon to calculate exact taxes payroll or other financial data. Without the gross up component the net pay for a reimbursement request would be only 353966.

It should not be relied upon to calculate exact taxes payroll or other financial data. Gross Up Pay Calculator. The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates.

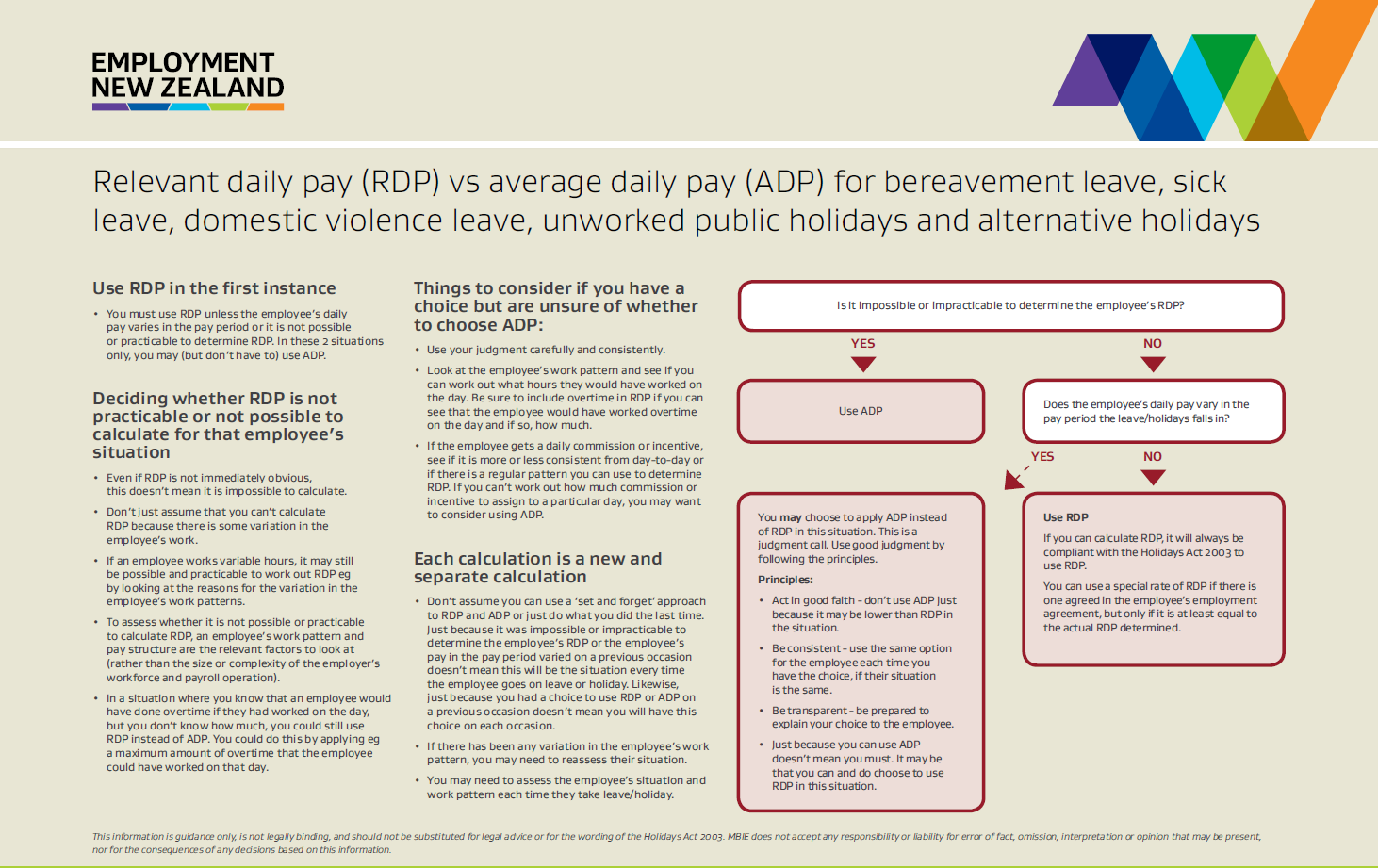

Its like calculating a paycheck backwards. The difference between the amount requested and the net pay is only the social security and medicare on the Total payment. ADP is a daily average of the employees gross earnings over the past 52 weeks.

Net Pay Net Percent Gross Pay. Gross-up Paycheck Calculator - Primepoint HRMS Payroll. It is perfect for small business especially those new to doing payroll.

For example if the federal tax rate is 22 and the State rate is 5 the total tax rate is 27. ADP Canada Canadian Payroll Calculator. Information For 51 to 1000 Employees.

The payroll calculators that are provided on this website are only meant to provide general guidance and estimates about the payroll process. If the employee is promised 5000 the payment can be grossed up so that after tax is withheld the employee will net 5000. Determine total tax rate by adding the federal and state tax percentages.

The federal supplemental tax rate is 22. It should not be relied upon to calculate exact taxes payroll or other financial data. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Intelligent user-friendly solutions to the never-ending realm of what-if scenarios. Calculators by Symmetry CBS are custom paycheck calculators for any gross-to-net calculation need. Then the average daily pay ADP method may be used.

Important Note on CalculatorThe calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. The results are broken up into three sections. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

Net payment net percent gross payment. Use this simple powerful tool whether your staff is paid salary or hourly and for every province or territory in Canada. Gross-Up Calculator Use the gross up pay calculator to gross up wages based on net pay.

Tax gross-up example 1. Youll just need a few things including your net or take-home pay amount. 566800 50131 11724 504945.

This is worked out by. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On. Get Pricing for 50 or Less Employees.

Http Event Lvl3 On24 Com Event 13 80 55 3 Rt 1 Documents Resourcelist1487182712542 34587 1hm Pdf Dummy Dummybody

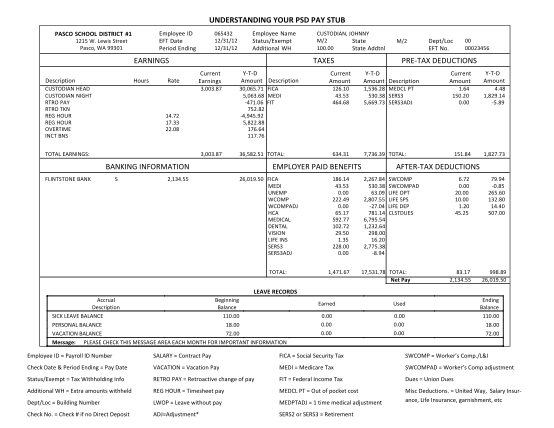

Https Www Ntiathome Org Sites Default Files Paychecks And Pay Statements 5102016 Pdf

Http Event Lvl3 On24 Com Event 13 80 55 3 Rt 1 Documents Resourcelist1487182712542 34587 1hm Pdf Dummy Dummybody

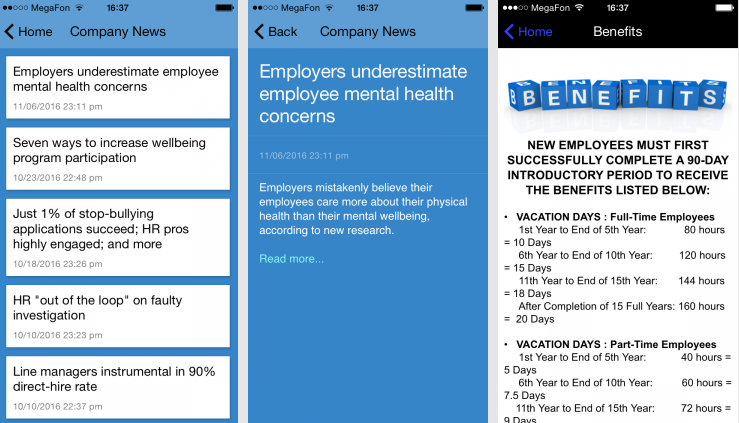

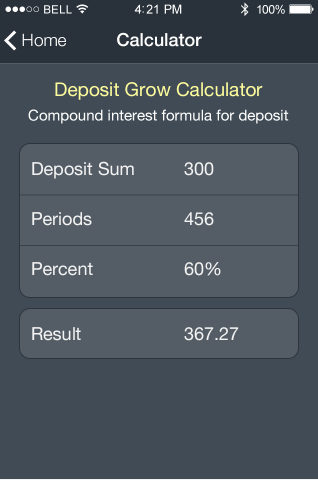

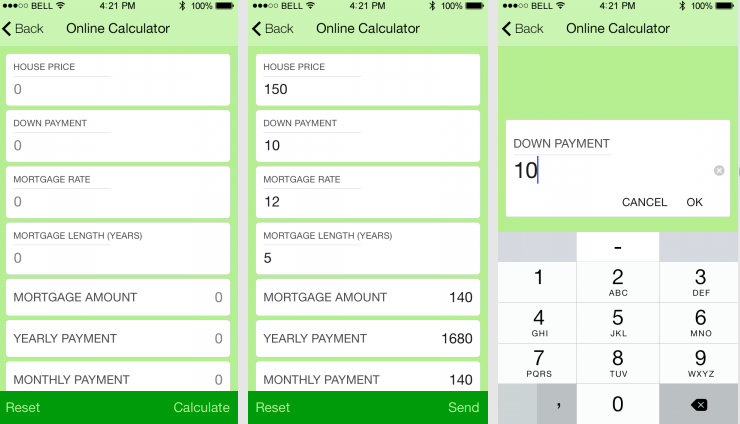

Create Your Own Adp Tax Payroll Hourly Paycheck Calculator App

Create Your Own Adp Tax Payroll Hourly Paycheck Calculator App

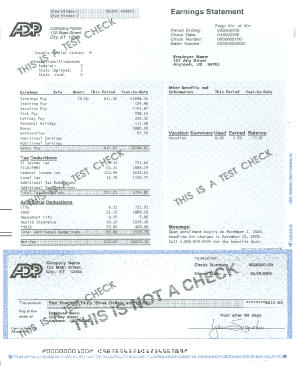

Adp Pay Stub Template Fill Out And Sign Printable Pdf Template Signnow

Https United Church Ca Sites Default Files Understanding Adp Payroll Reports 2019 Pdf

Relevant And Average Daily Pay Employment New Zealand

84 Paycheck Calculator Adp Page 5 Free To Edit Download Print Cocodoc

Top 7 Free Payroll Calculators Timecamp

How To Create A Pay Stub In Word Arxiusarquitectura

Https United Church Ca Sites Default Files Understanding Adp Payroll Reports 2019 Pdf

Pay Stub Copy Generator Pdfsimpli

Free Net To Gross Paycheck Calculator

Create Your Own Adp Tax Payroll Hourly Paycheck Calculator App

84 Paycheck Calculator Adp Free To Edit Download Print Cocodoc

Post a Comment for "Adp Paycheck Calculator Gross Up"