How To Calculate Take Home Pay After 401k Contribution

Subtract 12900 for Married otherwise subtract 8600 for Single or Head of Household from your computed annual wage. The PaycheckCity salary calculator will do the calculating for you.

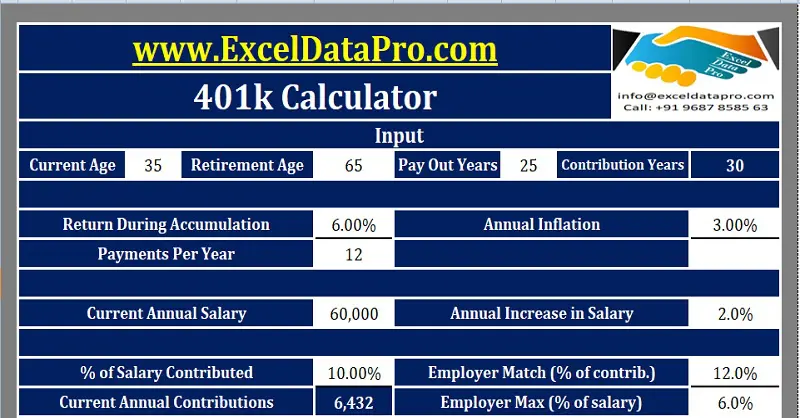

Customizable 401k Calculator And Retirement Analysis Template

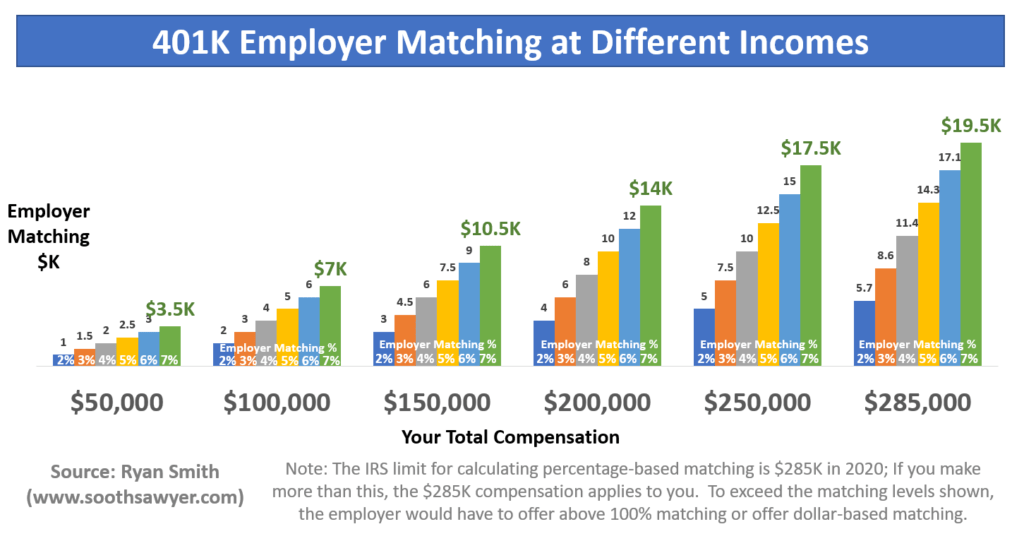

You should invest at least enough to receive your employers match even if you are focused on getting out of debt or saving for a house.

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How to calculate take home pay after 401k contribution. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Find out the benefit of that overtime. Subtract your 401 k contributions from gross income before calculating federal income tax the only federal withholding tax that 401 k pretax contributions.

This calculator allows employees to deduct 401k or 403b contributions for tax year 2020. Calculate your annual tax by the IRS provided tables. While take-home pay is net pay after taxes and other deductions gross pay is the total income an individual earns before taxes and deductions.

Second multiply your gross income per pay period by the percentage youve elected to contribute to your Roth 401k plan to determine your 401k plan withholding. Dont want to calculate this by hand. How to use the Take-Home Calculator.

To use the tax calculator enter your annual salary or the one you would like in the salary box above. If you have an annual salary of 25000 and contribute 6 your annual contribution is 1500. Figures entered into Your Annual Income Salary should be the before-tax amount and the result shown in Final Paycheck is the after-tax amount including deductions.

Subtract any deductions and payroll taxes from the gross pay to get net pay. First divide your annual salary by the number of pay periods per year to calculate your gross income per pay period. One of the easiest ways to increase the amount you contribute is to add to the amount you contribute each time you are given a raise.

You might not even notice a difference in your take-home pay. Taking out just the after-tax balance would not be allowed. Your gross pay is 1600 20 x 80 hours.

This number is the gross pay per pay period. Lets say you made 10000 in after-tax contributions and that money earned 2000 in returns. When you make a pre-tax contribution to your retirement savings account you add the amount of the contribution to your account but your take home pay is reduced by less than the amount of your contribution.

Enter the number of hours and the rate at which you will get paid. For 2020 we take your gross pay minus 4300 per allowance times this percentage to estimate your state and local taxes. In our example contributing to a pretax 401 k saves 2250 per biweekly paycheck or 585 a year allowing more money to be invested without decreasing overall take home pay.

401k Planner Estimate the future value of retirement savings based on the interest rate contribution amount and current balance. With a 50 match your employer will add another 750 to your 401 k account. And that applies if you are converting the after.

Note that we will use 8 as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage. Contributions to a qualified plan participation in a company-sponsored cafeteria plan change in filing status or number of allowances claimed will have a direct impact on take-home pay. Assumes 1250 biweekly salary 125 biweekly contribution and 18 combined state and federal tax rate.

This is the percentage that will be deducted for state and local taxes. For example due to federal tax savings contributions to a qualified plan do not translate into a direct dollar-for-dollar tradeoff on take-home pay. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. You may change any of these values. What you should know is that you wont be able to withdraw your after-tax contributions without also withdrawing any earnings associated with them.

Adjust the variables to see how the changes affect your savings goal. Your 401k balance at retirement is calculated by the 401k calculator. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be.

To get take-home pay you must subtract taxes and deductions. The 401k payout calculator is calculated by 401k balance at retirement years of retirement investment growth rate and income tax rate to calculate your payout from 401k account. Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay.

Use this take home pay calculator to help compare your current. Please note this calculator can only estimate your state and local tax withholding. For example you make 20 per hour and work 80 hours per pay period.

In the following boxes youll need to enter. If you increase your. For instance a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount.

This calculator uses the withholding schedules rules and rates from IRS Publication 15. In order to withdraw the 10000 the 2000 in earnings would need to be withdrawn as well. Years invested 65 minus your age Your initial balance.

That represents an increase in your take home pay. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

401k Contribution Impact On Take Home Pay Tpc 401 K

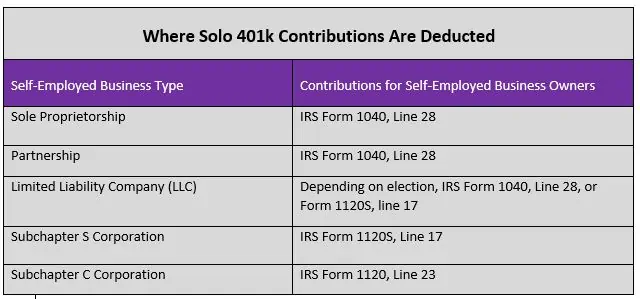

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

Who Should Make After Tax 401 K Contributions Smartasset

Free 401k Calculator For Excel Calculate Your 401k Savings

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

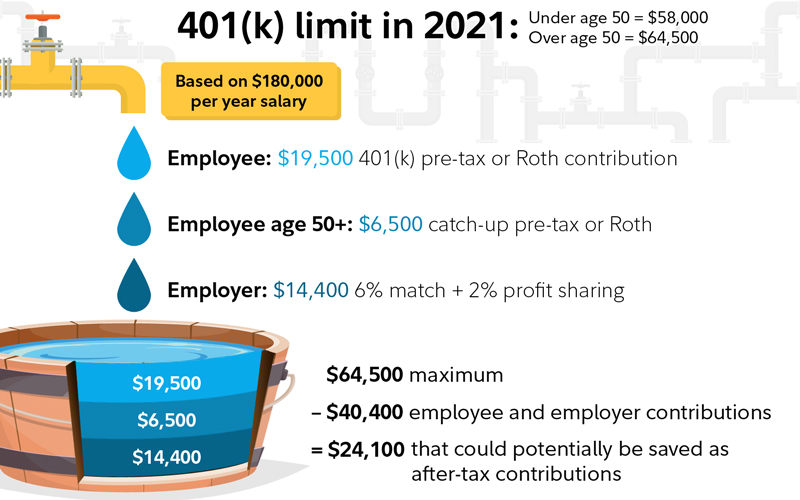

The Maximum 401k Contribution Limit Financial Samurai

Paycheck Calculator Take Home Pay Calculator

After Tax 401 K Contributions Retirement Benefits Fidelity

401k Contribution Impact On Take Home Pay Tpc 401 K

Retirement Services 401 K Calculator

401 K Calculator See What You Ll Have Saved Dqydj

How Much Can I Contribute To My Self Employed 401k Plan

Download 401k Calculator Excel Template Exceldatapro

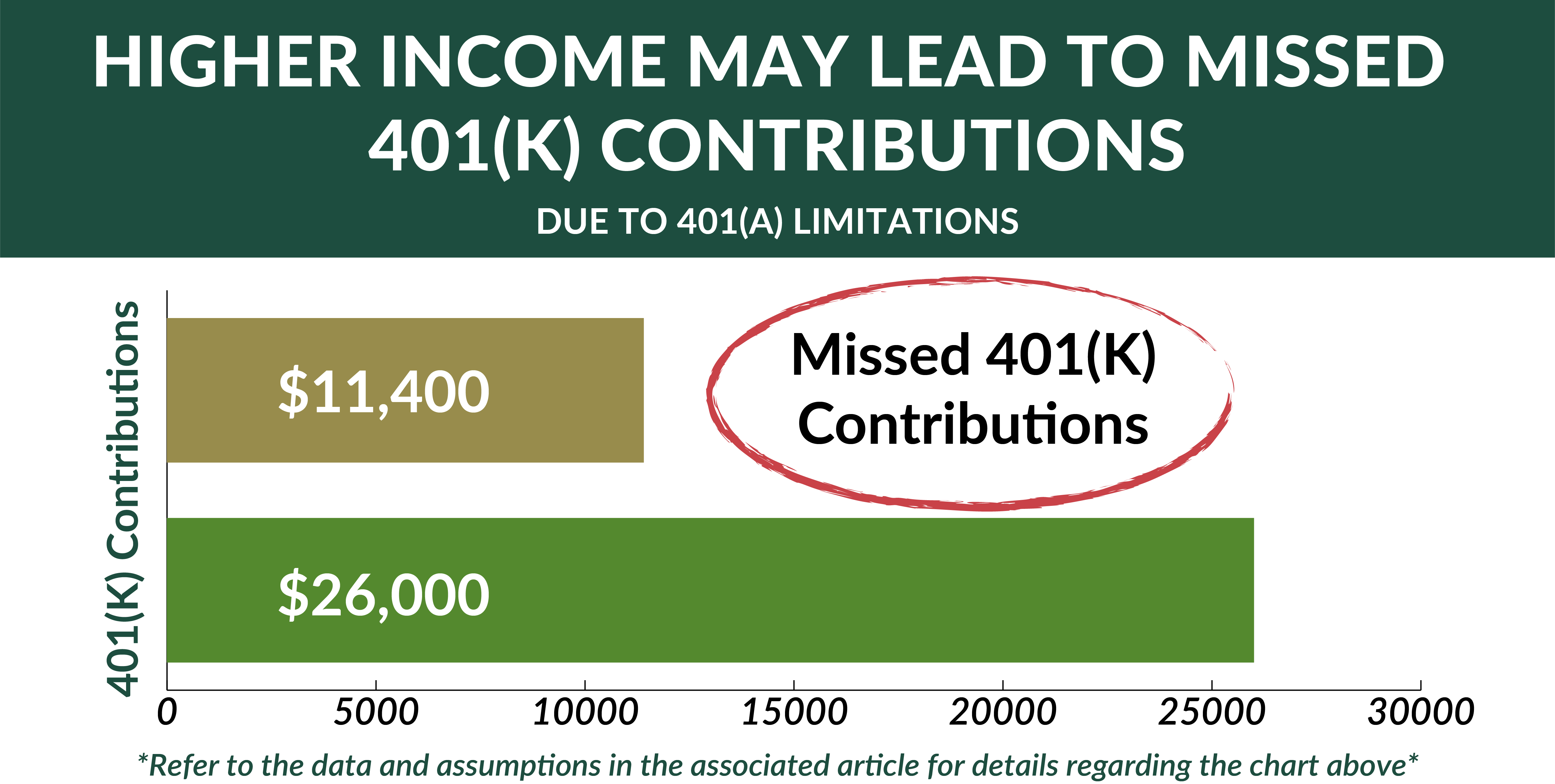

The 401 K Mistake Executives Earning Over 290 000 Make All The Time

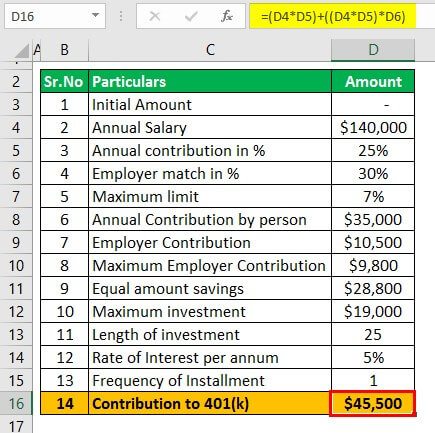

401k Contribution Calculator Step By Step Guide With Examples

Post a Comment for "How To Calculate Take Home Pay After 401k Contribution"