How To Figure My Paycheck After Taxes

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Simply select your state and the calculator will fill in your state rate for you.

Tax Information Career Training Usa Interexchange

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52.

How to figure my paycheck after taxes. List each type of income and how much will be taxable to estimate your tax rate. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. 11 income tax and related need-to-knows.

Income Tax Calculator 2021 - USA - Salary After Tax. In addition to income tax withholding the other main federal component of your paycheck withholding is for FICA taxes. For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387.

Subtracting the value of allowances allowed for. Your average tax rate is 222 and your marginal tax rate is 361. Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

Then enter the number of hours worked the gross pay hourly rate and pay period. Free tax code calculator Transfer unused allowance to your spouse. Subtract any deductions and payroll taxes from the gross pay to get net pay.

Add that up and then reduce that number by. You and your employer will each contribute 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. Check your tax code - you may be owed 1000s.

This marginal tax rate means that your immediate additional income will be taxed at this rateFor instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387. Tax-free childcare Take home over 500mth. FICA stands for the Federal Insurance Contributions Act.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This marginal tax rate means that your immediate additional income will be taxed at this rate. To try it out just enter the employee details and select the hourly pay rate option.

Plus the paycheck tax calculator includes a built-in state income tax withholding table. Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also withholds taxes from your pay. How to calculate taxes taken out of a paycheck.

Your average tax rate is 222 and your marginal tax rate is 361. How do I complete a paycheck calculation. Note that other pre-tax benefits could lower your taxable income further After-tax contributions are those you make from your net pay that is your income after taxes.

Uniform tax rebate Up to 2000yr free per child to help with childcare costs. Our hourly paycheck calculator accurately estimates net pay sometimes called take-home pay or home pay for hourly employees after withholding taxes and deductions. This number is the gross pay per pay period.

Calculating Your Tax Rate Your tax rate in retirement will depend on the total amount of your taxable income and your deductions. Federal income tax withholding was calculated by. Figures entered into Your Annual Income Salary should be the before-tax amount and the result shown in Final Paycheck is the after-tax amount including deductions.

How Your Paycheck Works. How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage.

For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your taxable income for the year would have been 27000. Marriage tax allowance Reduce tax if you wearwore a uniform. Subtract any deductions and payroll taxes from the gross pay to get net pay.

This number is the gross pay per pay period. You can choose between weekly bi-weekly semi-monthly monthly quarterly semi-annual and annual pay periods and between single married or head of household. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a.

How do I complete a paycheck calculation.

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Co Uk Apps Games

Paycheck Calculator Take Home Pay Calculator

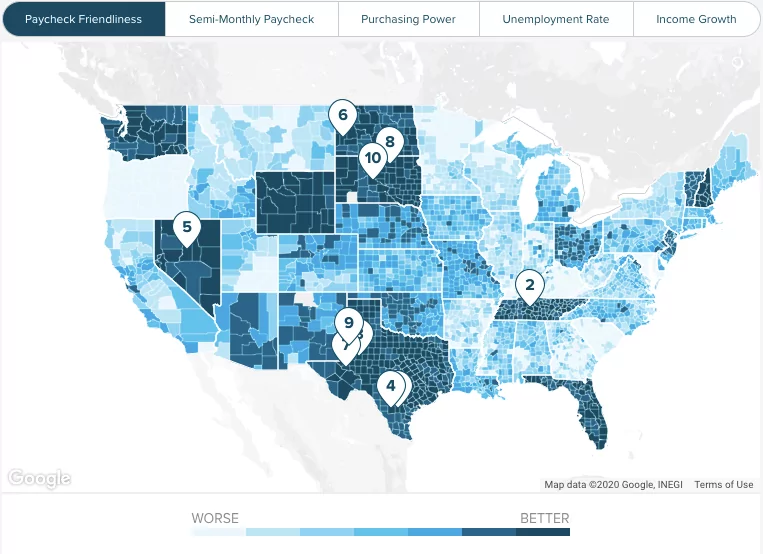

California Paycheck Calculator Smartasset

New Tax Law Take Home Pay Calculator For 75 000 Salary

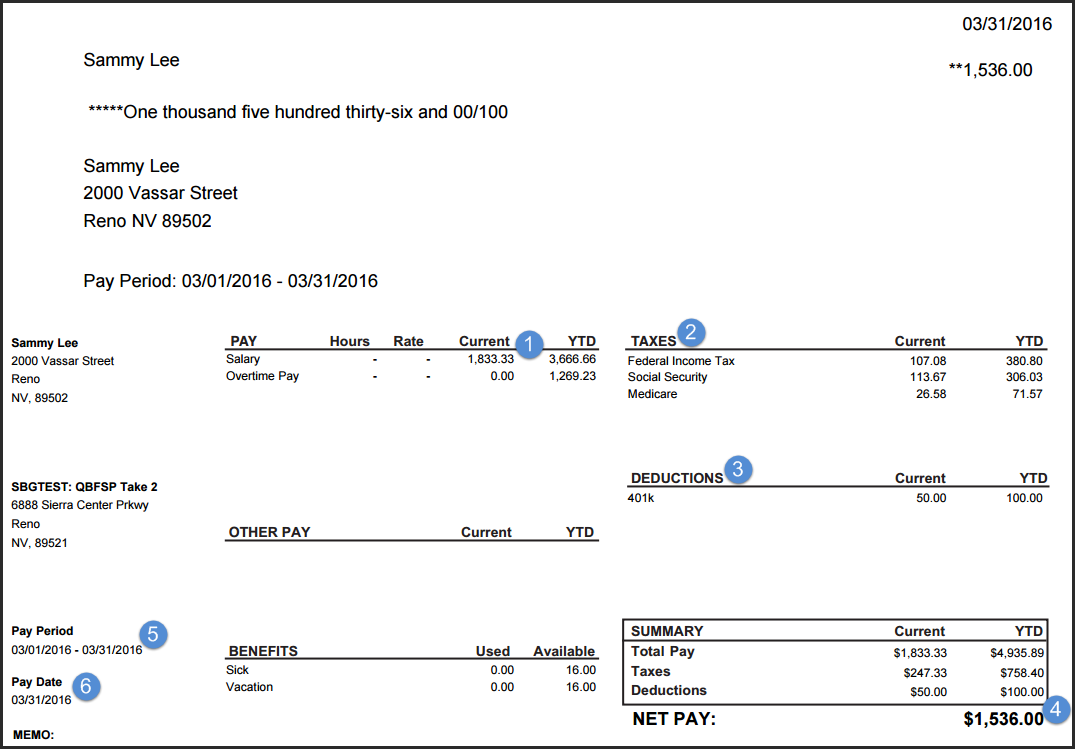

Understanding Your Paycheck Credit Com

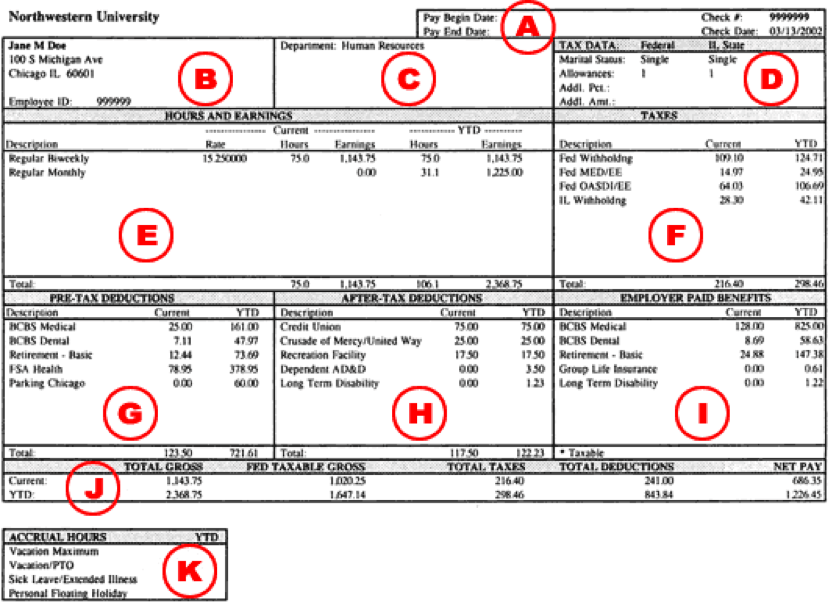

Understanding Your Pay Statement Office Of Human Resources

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Fatten Your Paycheck And Still Get A Tax Refund Turbotax Tax Tips Videos

How Much Is 15 Dollars An Hour Biweekly After Taxes Tax Walls

Texas Paycheck Calculator Smartasset

Paycheck Calculator For Excel Paycheck Salary Calculator Payroll Taxes

How Much Is 15 Dollars An Hour Biweekly After Taxes Tax Walls

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator Take Home Pay Calculator

Understanding Your Paycheck Human Resources Northwestern University

How To Understand Your Paycheck And Meet Your Tax Goals

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Post a Comment for "How To Figure My Paycheck After Taxes"