Paycheck Calculator California Bonus

This is state-by state compliant for those states who. Rather than using a flat tax rate the bonus is added to regular wages to determine the additional taxes due.

How To Fill Out The W 4 Tax Withholding Form For 2021

California State Controllers Office.

Paycheck calculator california bonus. Employees overtime pay rate 2175 the regular rate of pay is 1450 12 hourly wage 250hour bonus Step 3. This must then be multiplied by 15 to get the total amount of overtime bonus pay. To try it out just enter the employee details and select the hourly pay rate option.

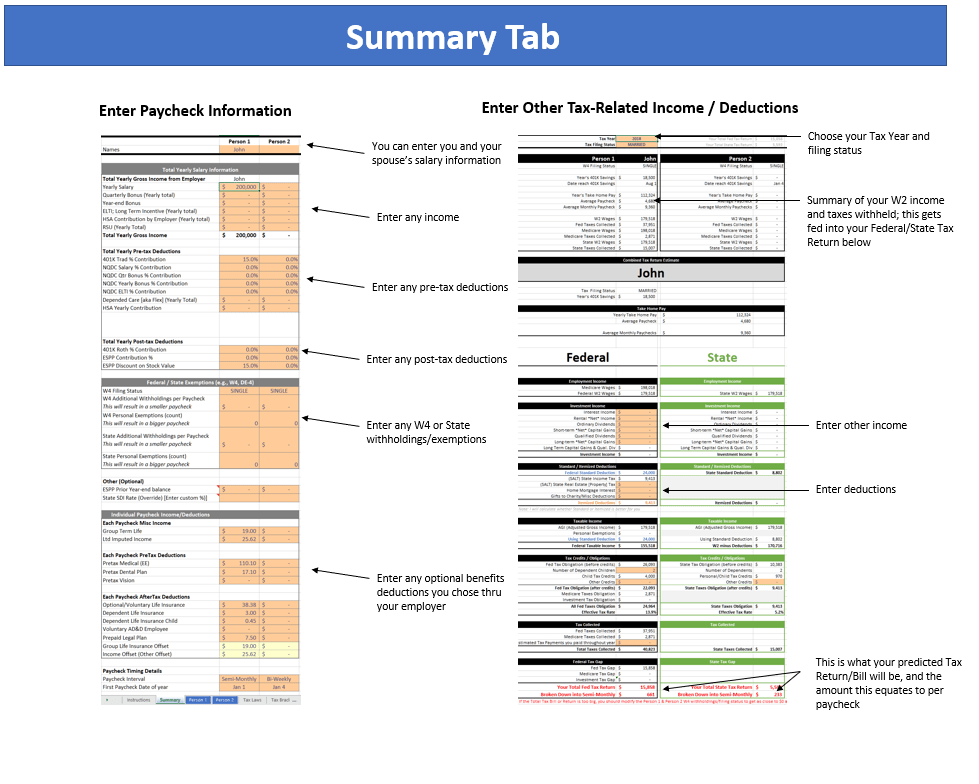

This calculator determines the amount of gross wages before taxes and deductions are withheld given a specific take-home pay amount. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Calculating overtime with employee bonuses in california Calculating overtime for weeks when a worker earns a nondiscretionary production bonus can be is a trap for unwary employers.

Determine taxable income by deducting any pre-tax contributions to benefits. Then enter the number of hours worked the gross pay hourly rate and pay period. Calculate withholding on special wage payments such as bonuses.

If this is the case you may see a difference between your pay and the Payroll Deductions Online Calculator. The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. In California these supplemental wages are taxed at a flat rate.

If you make more than a certain amount youll be on the hook for an extra 09 in Medicare taxes. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. It also issued regulations updating the federal income tax withholding tables and computational procedures in Publication 15-T Federal Income Tax.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. This includes overtime commission awards bonuses payments for non-deductible moving expenses often called a relocation bonus severance and pay for accumulated sick leave. How to calculate net income.

California employees will usually be entitled to calculate their regular pay under California law because it is more favorable to employees than federal law Labor Code 515 subd. It is not a substitute for the advice of an accountant or other tax professional. You must discern the amount of overtime worked per regularly scheduled hours.

Some employees earn supplemental wages. If your state does not have a special supplemental rate you will be forwarded to the aggregate. Although our salary paycheck calculator does much of the heavy lifting it may be helpful to take a closer look at a few of the calculations that are essential to payroll.

Incentive bonuses include flat sum bonuses. This difference will be reconciled when you file your 2020 tax return. If your state does not have a special supplemental rate you will be forwarded to the aggregate bonus calculator.

Payroll check calculator is updated for payroll year 2021 and new W4. 145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145. There is no income limit on Medicare taxes.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Paycheck Calculator Download The Internal Revenue Service IRS redesigned the Form W-4 Employees Withholding Certificate to be used starting in 2020. Salary paycheck calculator guide.

The California Department of Labor Standards and Enforcement has set out guidelines that describe the method of calculating overtime bonus pay. The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Our hourly paycheck calculator accurately estimates net pay sometimes called take-home pay or home pay for hourly employees after withholding taxes and deductions.

This calculator uses the Aggregate Method. Bonuses and earnings from stock options are taxed at a flat. To properly compute overtime on a flat sum bonus the bonus must be divided by the maximum legal regular hours worked in the bonus-earning period not by the total hours worked in the bonus-earning period.

As a result your employer may be using a different Yukon Basic Personal Amount to calculate your pay. Multiply the employees overtime pay rate by the number of overtime hours. These calculators use supplemental tax rates to calculate withholdings on special wage payments such as bonuses.

If your state doesnt have a special supplemental rate see our aggregate bonus calculator. This calculation will produce the regular rate of pay on the flat sum bonus earnings. Or Select a state.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for California residents only. Bonus Tax Percent Calculator. 2175 x 10 overtime hours 21750 in overtime compensation owed for hours 41-50.

Under California and federal law employers must calculate overtime pay based on an employees regular rate of pay. D2 Payment of a fixed salary to a nonexempt employee shall be deemed to provide compensation only for the employees regular non-overtime hours.

25 Great Pay Stub Paycheck Stub Templates Excel Templates Payroll Template Salary

Calculate Your Paycheck With Paycheck Calculators And Withholding Calculators Paycheckcity

Advanced Paycheck Tax Calculator By Ryan Smith Soothsawyer

Advanced Paycheck Tax Calculator By Ryan Smith Soothsawyer

Fresh Blank Business Check Template Word In 2021 Payroll Template Paycheck Business Checks

Paycheck Calculator Take Home Pay Calculator

How Bonuses Are Taxed Credit Karma Tax

![]()

Bonus Tax Calculator How To Calculate Bonus Paychecks The Turbotax Blog

How Are Bonuses Taxed With Bonus Calculator Minafi

Businessmen Check Stub Template Workers And Normal People Who Use Checks For Daily Purposes Need To Statement Template Payroll Template Professional Templates

Bonus Tax Calculator How To Calculate Bonus Paychecks The Turbotax Blog

Bonus Tax Calculator How To Calculate Bonus Paychecks The Turbotax Blog

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

Bonus Calculator Percentage Method Primepay

Bonus Time How Bonuses Are Taxed And Treated By The Irs The Turbotax Blog

Download Bonus Paystub Template 01 Pay Stubs Template Pay Stub Paystub Template

Paycheck Calculator Take Home Pay Calculator

Bonus Tax Calculator How To Calculate Bonus Paychecks The Turbotax Blog

Post a Comment for "Paycheck Calculator California Bonus"