Paycheck Calculator California Head Of Household

The state fiscal year is also 12 months but it differs from state to state. Choosing this status by mistake may lead to your HOH filing status being denied at the time you file your tax return.

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

Be sure you meet all the qualifications.

Paycheck calculator california head of household. If you earn over 200000 youll also pay a. Amount at the head of the column. 124 for social security tax and 29 for Medicare.

The Florida Salary Calculator allows you to quickly calculate your salary after tax including Florida State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Florida state tax tables. This calculator is intended for use by US. The self-employment tax applies evenly to everyone regardless of your income bracket.

Also use this field to enter PERS adjustments and PERSSTRS Retirement buy back shown as Yes CALIFORNIA STATE CONTROLLERS OFFICE PAYCHECK CALCULATOR - 2021 TAX RATES Enter annual dollar amount see instructions below. Rate 1 Hours 1. One of a suite of free online calculators provided by the team at iCalculator.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. It should not be relied upon to calculate exact taxes payroll or other financial data. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

P1 Select Your Filing Status. Computes federal and state tax withholding for paychecks. But to qualify you must meet specific criteria.

Claiming dependents might affect your pay. Head of household HOH filing status allows you to file at a lower tax rate and a higher standard deduction than the Single filing status. Flexible hourly monthly or annual pay rates bonus or other earning items.

Some states follow the federal fiscal year some states start on July 01 and end on Jun 30. Do not complete if using revised STD 686 or STD 457 effective 122020. Choose Cycle Daily Weekly Bi-Weekly Monthly Semi-Monthly Quarterly Semi-Annually Annually Miscellaneous.

One big factor affecting your paycheck taxes is your marital status and whether you decide to file jointly or separately from your spouse. California state income tax. This California hourly paycheck calculator is perfect.

401k 125 plan county or other special deductions. Similar to the fiscal year federal income tax. Rate 2 Hours 2.

The 1099 tax rate consists of two parts. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. The income tax rate ranges from 1 to 1330.

Any Coloradans who are common-law couples also have the option to file jointly. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. California Hourly Paycheck Calculator.

The calculation is based on the 2021 tax brackets and the new W-4 which in. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

It compares the taxes a married couple would pay filing a joint return with what they would pay if they were not married and each filed as single or head of household. Filing as head of household will also change things. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period.

This calculator lets you create specific situations to see how much federal income tax two people might pay if they were to marry. The state is known for plenty of American icons. Use this free tax return calculator to estimate how much youll owe in federal taxes using your income deductions and credits in just a few steps.

Being the most populous US state California state has a population of over 39 million 2019 and is an economic powerhouse larger than all but eight countries. Number of Qualifying Children. Choose Marital Status Single or Dual Income Married Married one income Head of Household.

Step 1c of the W-4. Estimate your 2021 Paycheck Tax Withholding. California Salary Paycheck Calculator.

It can also be used to help fill steps 3 and 4 of a W-4 form. Dare to Compare Now. Rate 3 Hours 3.

The median household income is 71805 2017. Daily Weekly Bi-Weekly Bi-Weekly 9 monthsyr Semi-Monthly Monthly Quarterly Semi-Annually Yearly. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator.

Important Note on Calculator. Single Head of Household Married Filing Jointly Married Filing Separately Qualifying Widow er P2 How Often Do You Get Paid. Payroll check calculator is updated for payroll year 2021 and new W4.

Paying Taxes On Your Self-Employment Income. The biggest reason why filing a 1099-MISC can catch people off guard is because of the 153 self-employment tax. Per pay period Annually.

The fiscal year 2021 will starts on Oct 01 2020 and ends on Sep 30 2021.

Paperwork Needed For Buying A House Home Buying Home Buying Process Buying First Home

California State Income Tax Brackets And How Your Income Is Taxed Ask Spaulding

Alimony Payments Of Divorced Or Separated Individuals 2020

Amazon Com Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Apps Games

Free Online Paycheck Calculator Calculate Take Home Pay 2021

10 Tax Deductions For Seniors You Might Not Know About

Purchaser Required For A Well Reputed Construction Company Accounting Jobs Accounting Services Accounting

California Hourly Paycheck Calculator Paycheckcity

Coupon Tips Fabulessly Frugal Extreme Couponing Money Sense Saving Money Frugal Living

New York Paycheck Calculator Smartasset

2020 2021 Tax Brackets Rates For Each Income Level

Paycheck Calculator Salaried Employees Primepay

Money Saving Tip Shorten Length Of Dryer Vent Budget Savvy Diva Saving Tips Saving Money Money Saving Tips

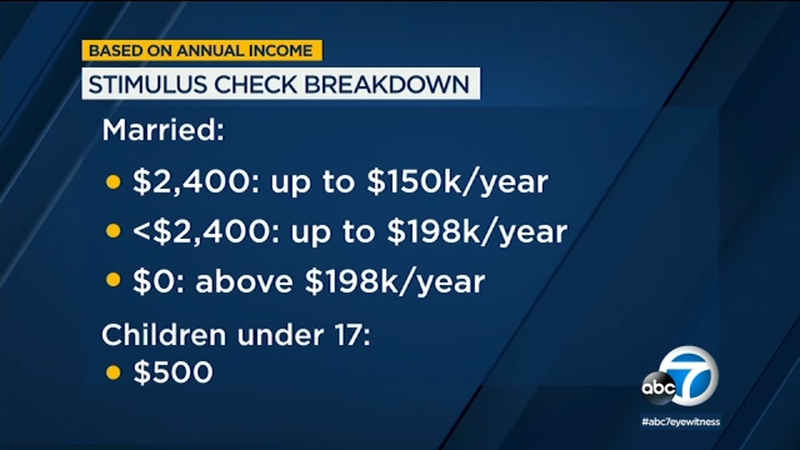

Stimulus Check Calculator How Much Money Should You Expect From Coronavirus Relief Bill Abc7 San Francisco

How To Hide That Fupa Diy Using Cardboard Youtube Dresses To Hide Tummy Womens Strapless Tops Dress To Hide Belly

How To Work With Lenders For The Brrrr Method A Massive Open Secret To Brrrr Success Lenders Open Secrets Method

Simple Tax Refund Calculator Or Determine If You Ll Owe

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Post a Comment for "Paycheck Calculator California Head Of Household"